Most You Can Put In 401k

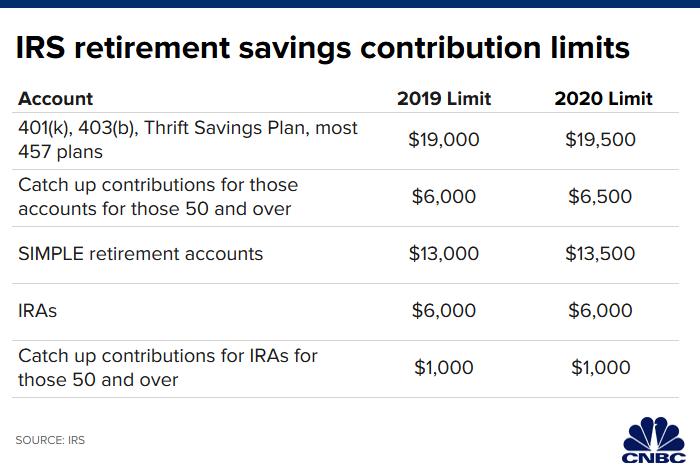

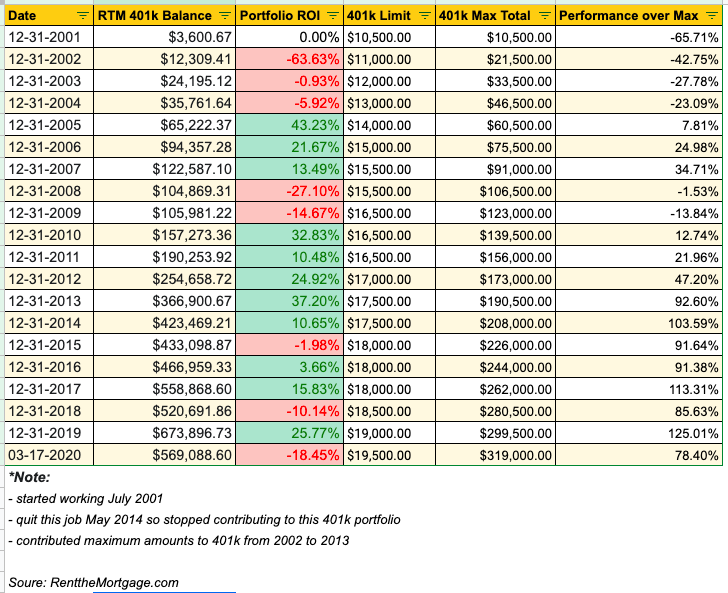

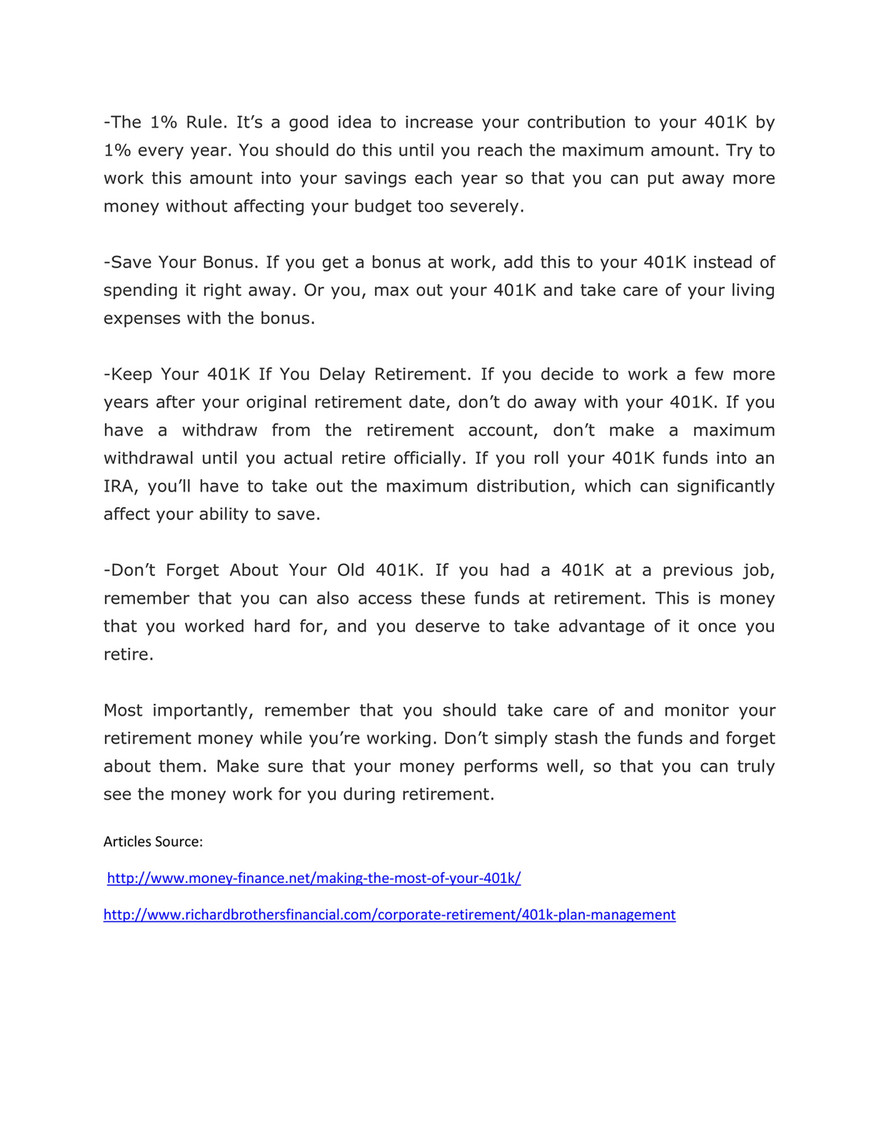

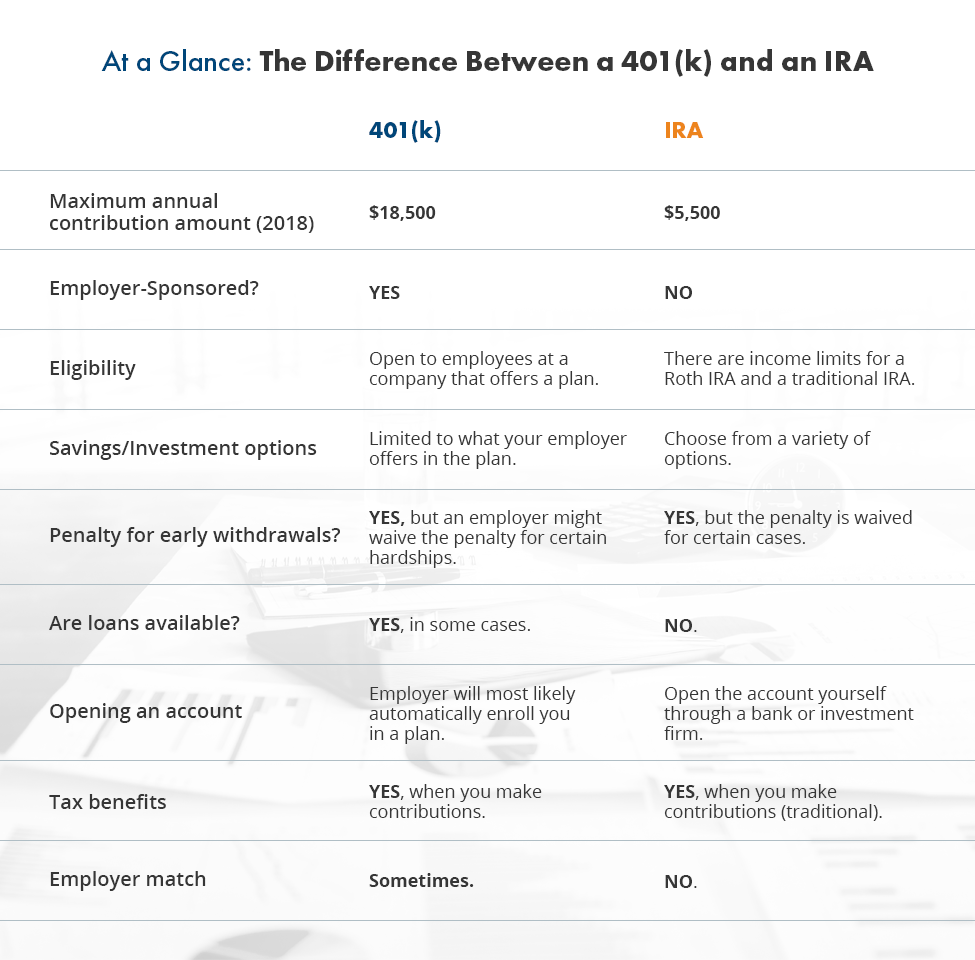

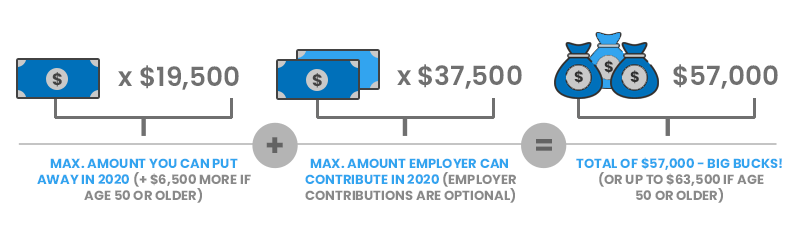

The maximum amount you can contribute in 2020 to a 401k as an employee is 19500.

Most you can put in 401k. The new 401k contribution limits for 2020. That is 500 more than the 401k limit for 2019. Money goes in after taxes are paidall the gain is tax free and you pay no tax when you withdraw it.

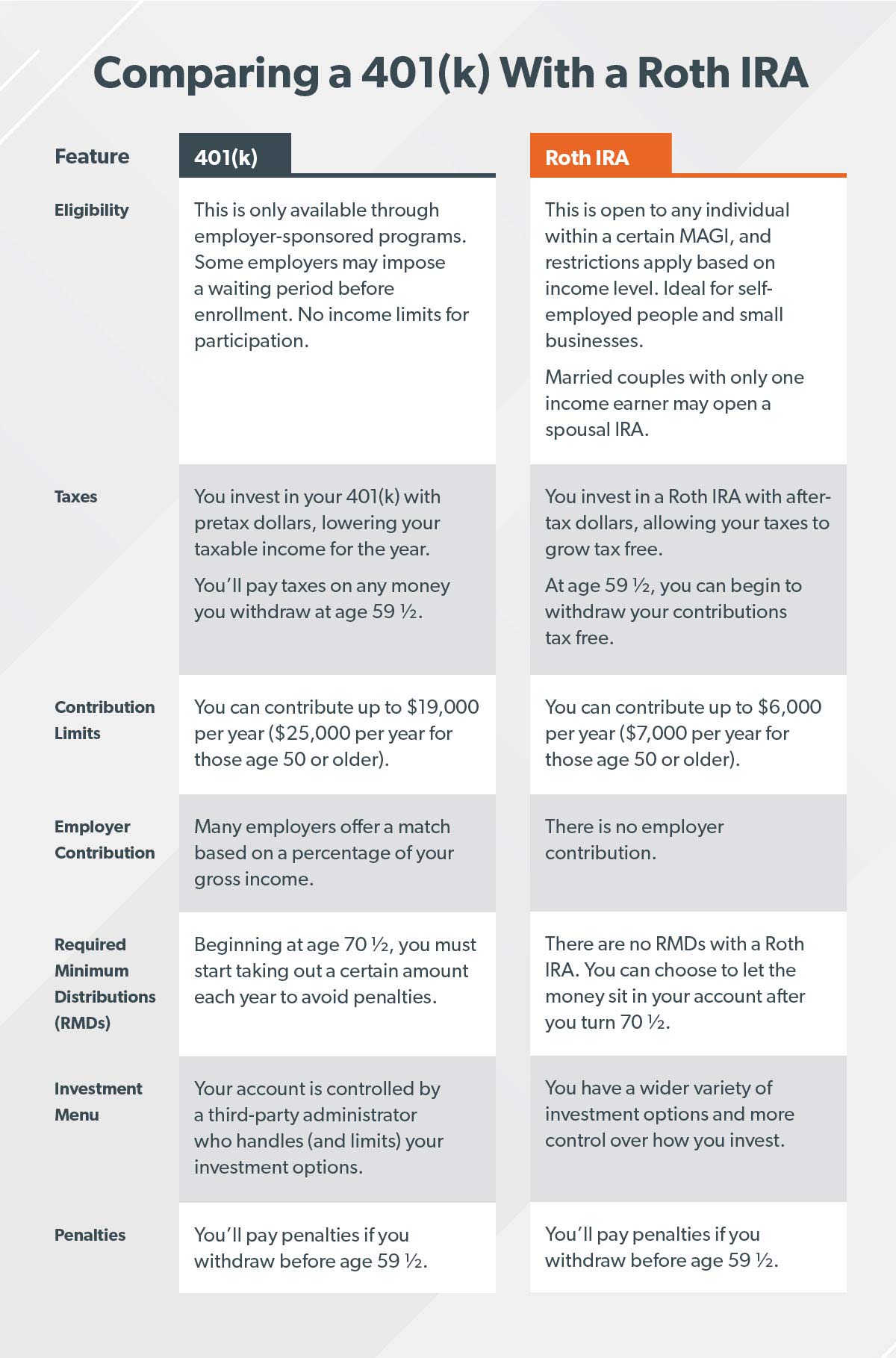

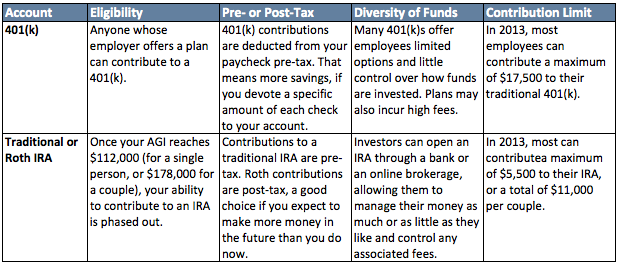

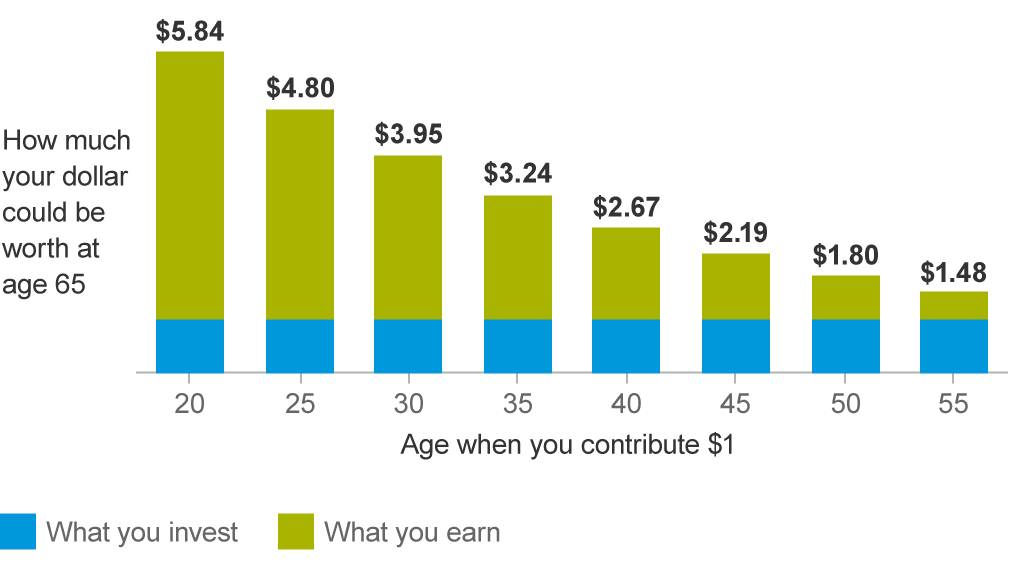

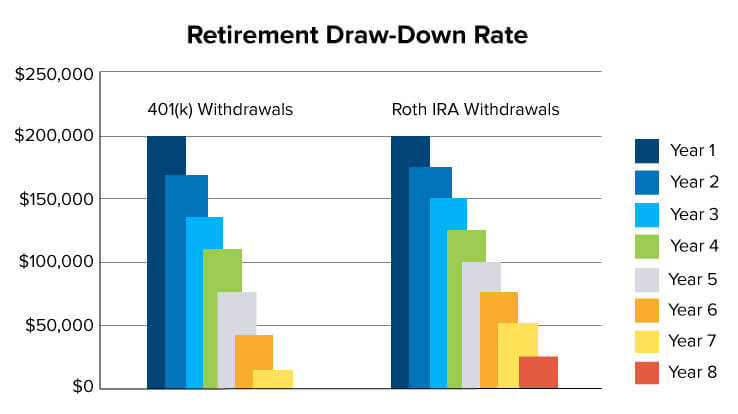

The money in a 401k plan isnt taxable until you withdraw it. If youre age 50 and older you can add an. If you invest in both a 401k and a roth 401k the total amount of money you can contribute to both accounts cant exceed the annual limit for your age either 19000 or 25000 for 2019.

Once you reach your pretax contribution limit you can then put in after tax money. Employees can contribute up to 19500 to their 401k plan for 2020 up 500 from 2019. Money is put in on a tax deferred basisthat is its subtracted from your taxable income for the year.

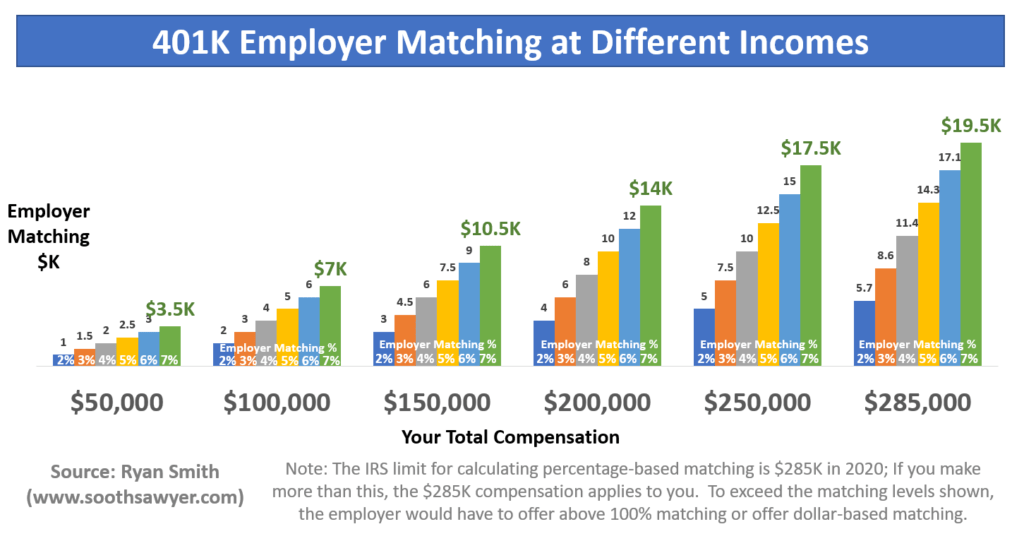

Workers age 50 and older can contribute an additional 6500 in 2020. Qualifying for a 401k match is the fastest way to build wealth for retirement. The 401k contribution limit is 19500 in 2020.

When you add up all the different types of contributions that you have made they have to stay within the limit that is set for 401ks. The maximum amount workers can contribute to a 401k for 2020 is 500 higher than it was in 2019its now up to 19500 if youre younger than age 50. As of 2010 the total annual limit is 49000.

Youll pay tax on it when you withdraw it. Roth 401k contribution called a designated roth account. You can contribute up to 19500 to your 401k in 2020 or 26000 if youre age 50 or over.

Any employer match that you receive does not count toward this limit. Some 401ks allow you to make after tax contributions to your account. Anyone age 50 or over is eligible for an additional catch up contribution of 6000 in 2019 and 6500 in 2020.

In 2020 the most you can contribute to a 401k is 19500 up from 19000 in 2019.

/GettyImages-528288920-bc900a0d510f4c2b98cebce020523e60.jpg)

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png)

/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-01-f213028d0331407980819f8e344c1e30.jpg)

/why-you-should-and-should-not-max-out-401k-28eb4c0fef7a40a9b630a83c4a0d884b.png)

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png)

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

/401k-investing-success-tips-56a090ef5f9b58eba4b19e9c.jpg)

:strip_icc()/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-01-f213028d0331407980819f8e344c1e30.jpg)