Most You Can Put In 403b

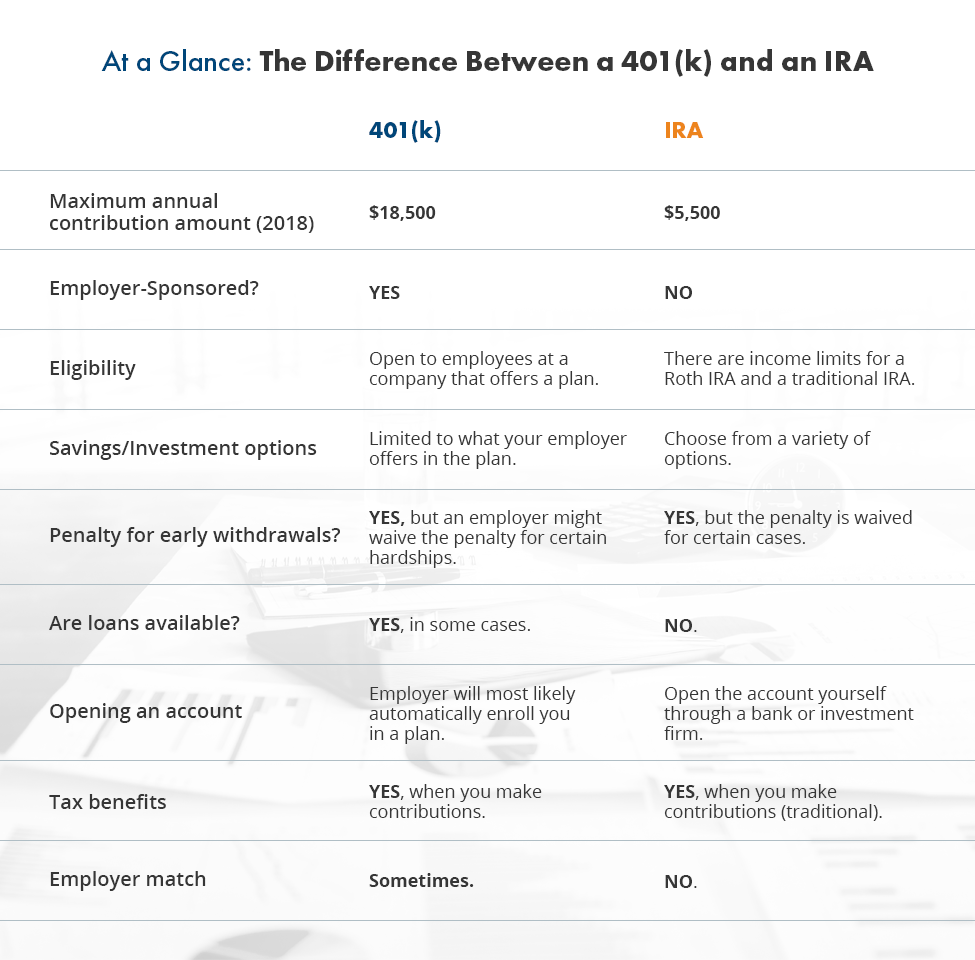

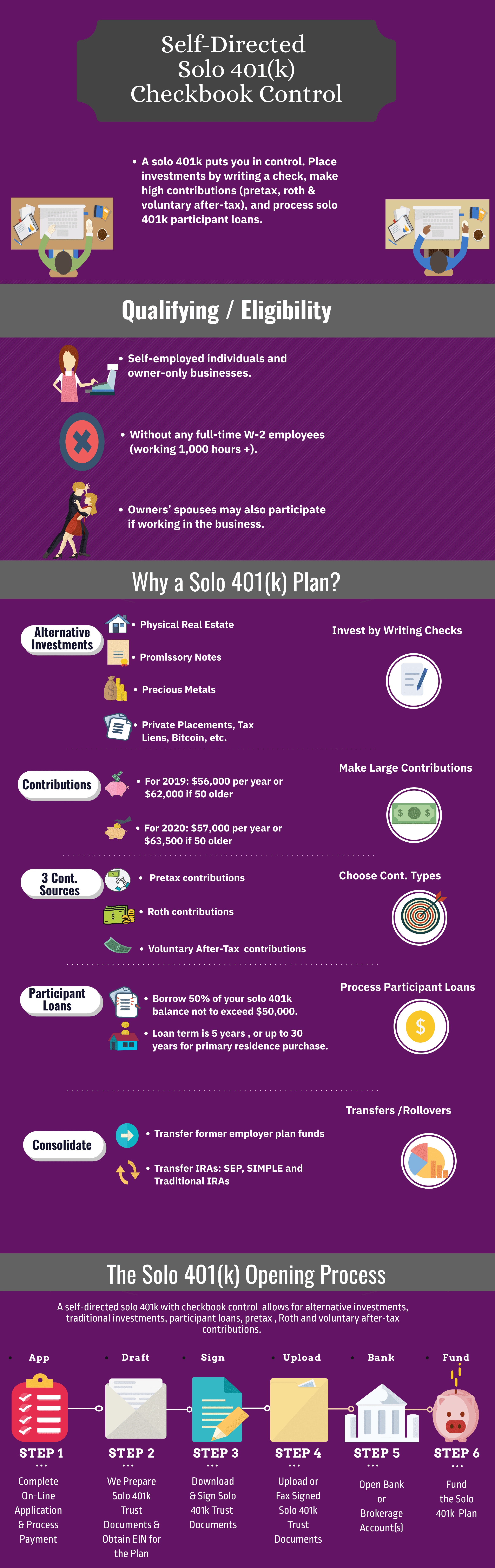

You can also roll over all or part of your 403b into a 401k if you change jobs or a traditional or roth ira among other accounts in order to benefit from more varied investment options or.

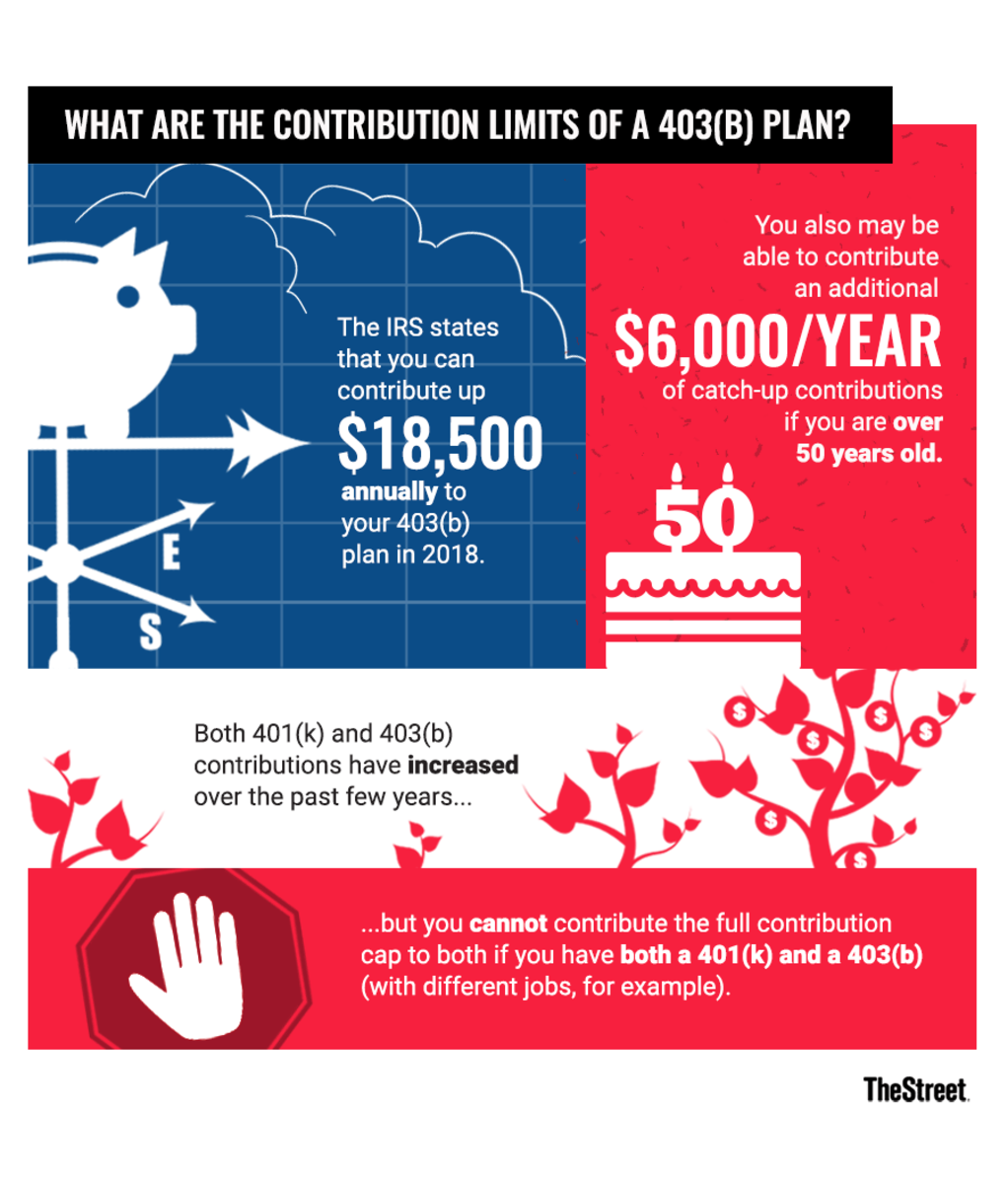

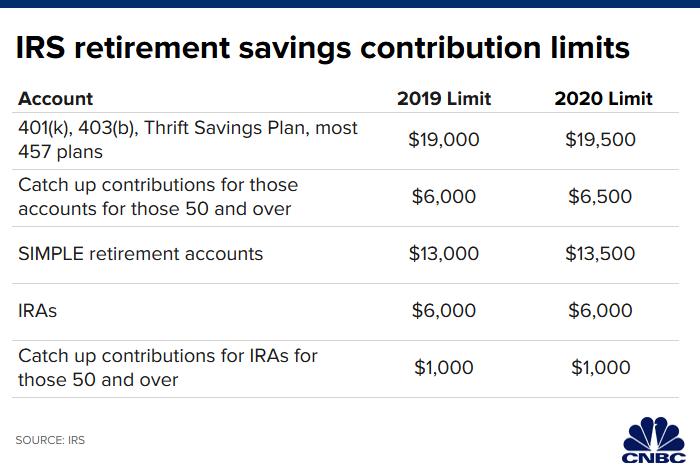

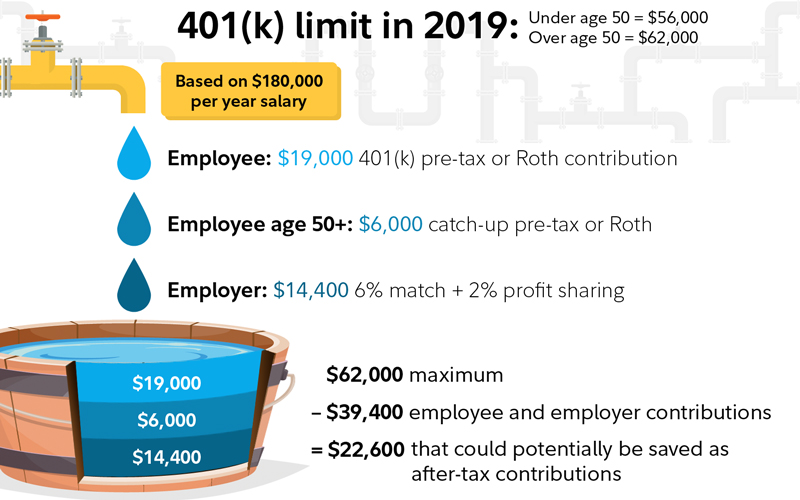

Most you can put in 403b. Adults 50 and older may contribute an additional 6500 in catch up contributions. Second many employers provide matching contributions to your 403b account which can range from 0 to 100 of your. This quick question and answer session can help you.

You can contribute a maximum of 18000 in 2016 if you are younger than 50 years old. The 403b plan has been around for a long time but compared to the 401kits more famous retirement plan cousinit gets little attention. This is in addition to the 19500 that all employees can put aside.

For some they have the availability to utilize a 457 plan as well. Some people are eligible for an additional 403b contribution known as a 403b lifetime catch up. Employers can match an employees contribution for the year.

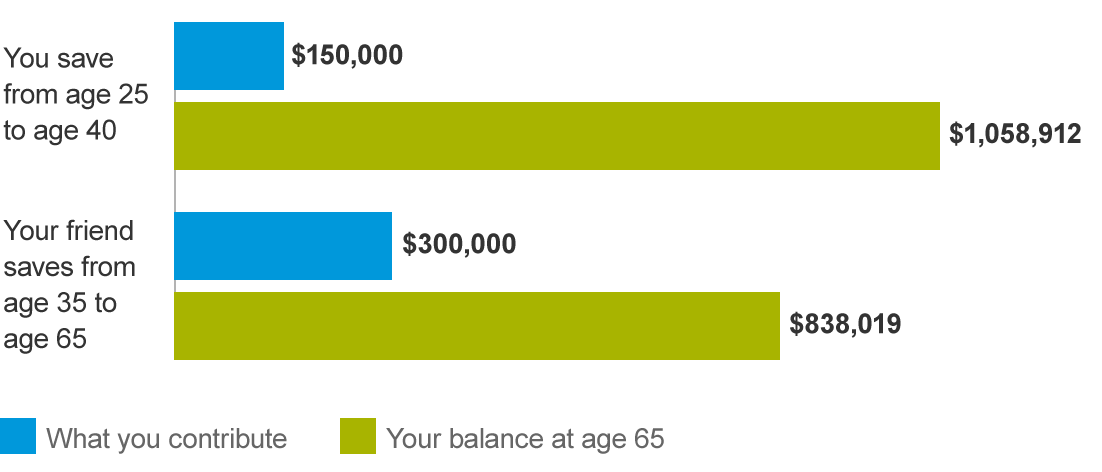

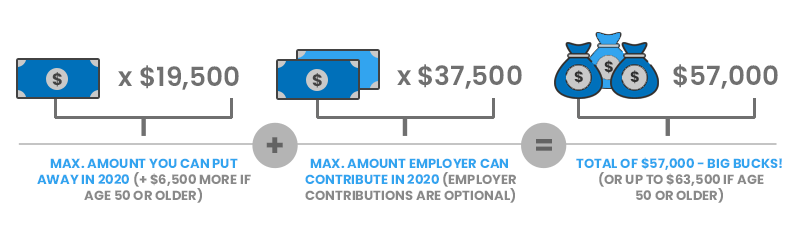

The most a taxpayer can contribute as an elective deferral to a 403b plan is 19500 as of 2020. You may contribute up to 19500 to a 401k or a 403b in 2020 if youre under 50. Its important to understand the ins and outs of these plans and understand how you can take full advantage of them.

If you are age 50 or older you can contribute an additional 6500 for 2020 as a catch up contribution. You only pay taxes on contributions and earnings when the money is withdrawn. If you are 50 or older you can make an additional catch up contribution of as much as 6000 for a total of.

If youre 50 or older you can contribute an additional 6500 as a catch up. 403b plans what is a 403b. Simply put a 403b is a retirement plan that is offered by public schools many tax exempt organizations and churches.

Amazon Com Improve Your Employer S 401k Plan How To Cut Your Fees And Keep More Of The Money You Invest For Retirement Ebook Zoril Mark Kindle Store

www.amazon.com

/GettyImages-534599671-8271fe8d319b4e62913dcde824ac651d.jpg)

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

/why-you-should-and-should-not-max-out-401k-28eb4c0fef7a40a9b630a83c4a0d884b.png)

:strip_icc()/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png)