Most You Can Put In A Ira

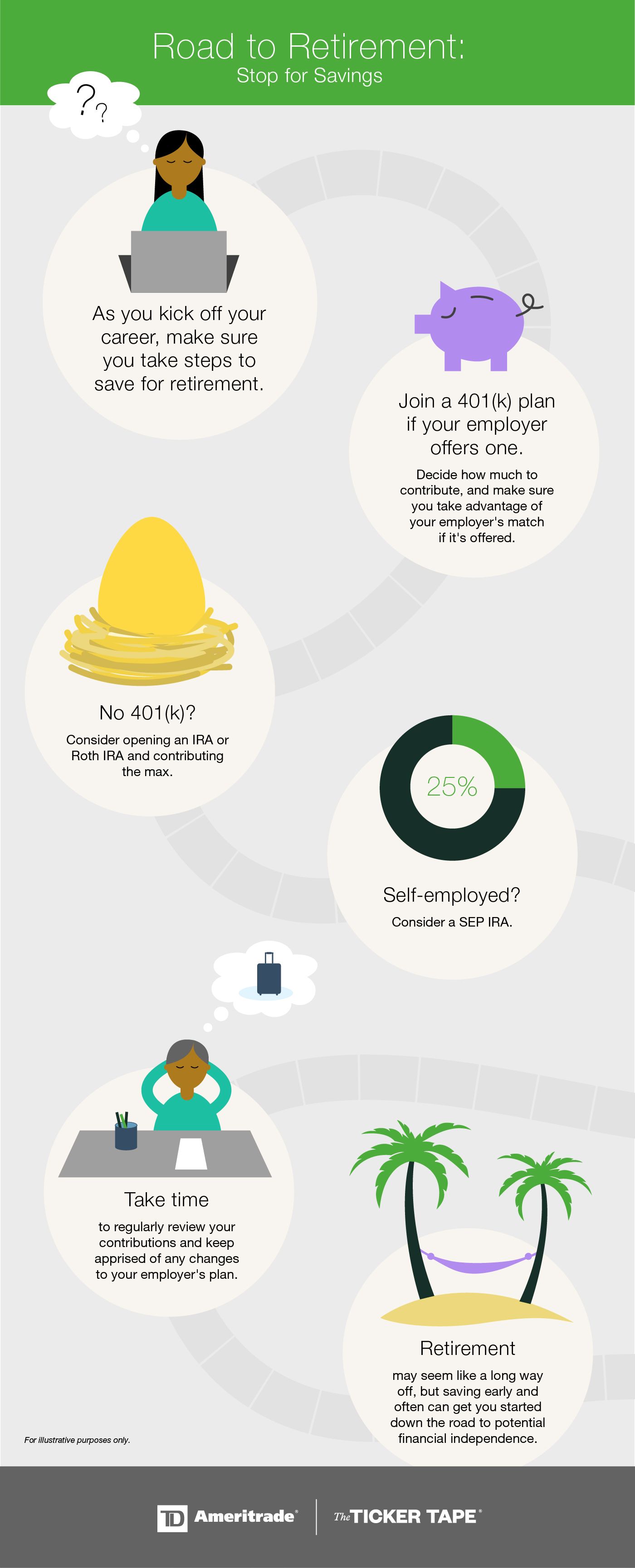

Others can be opened by self employed individuals and small.

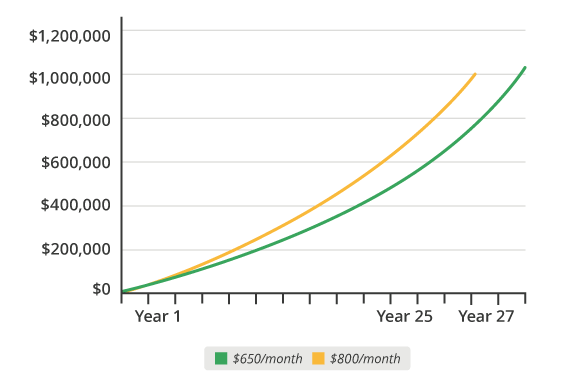

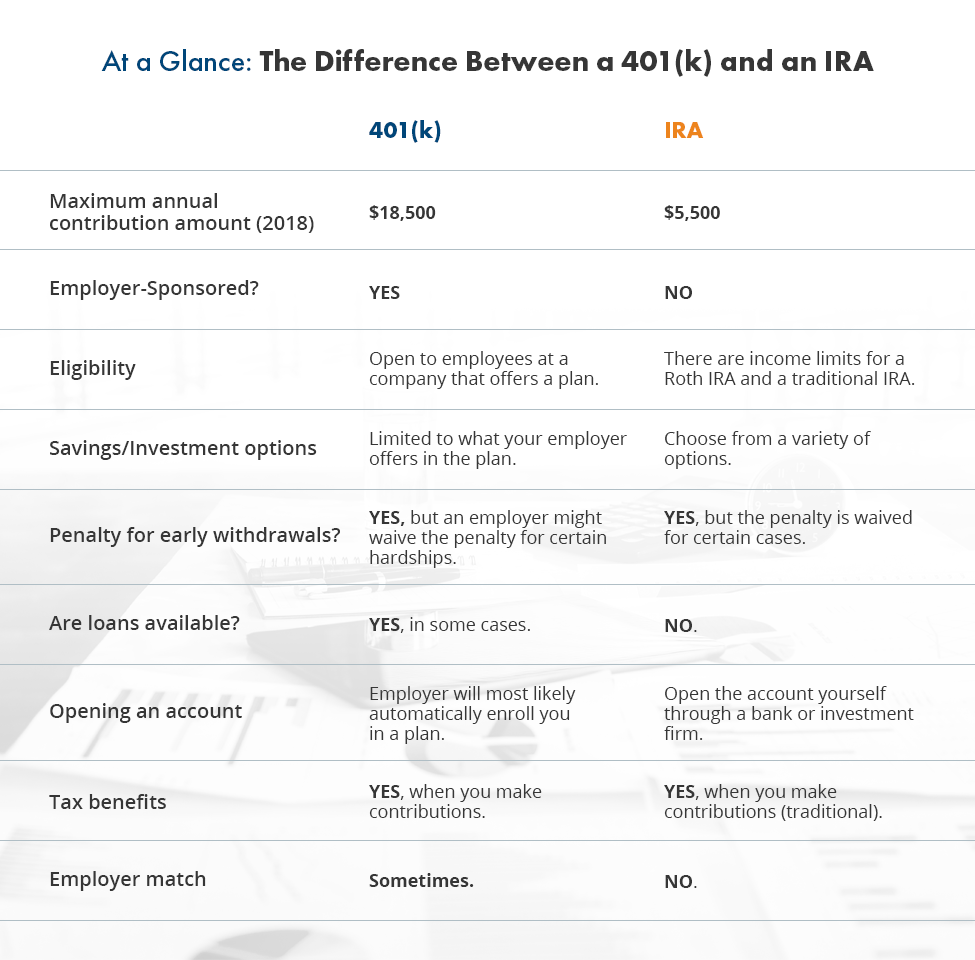

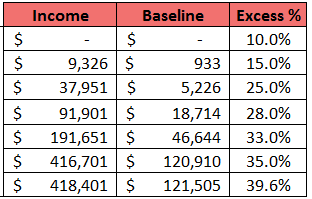

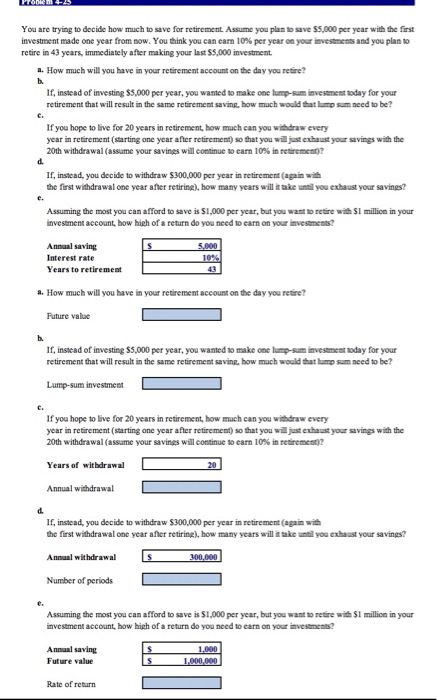

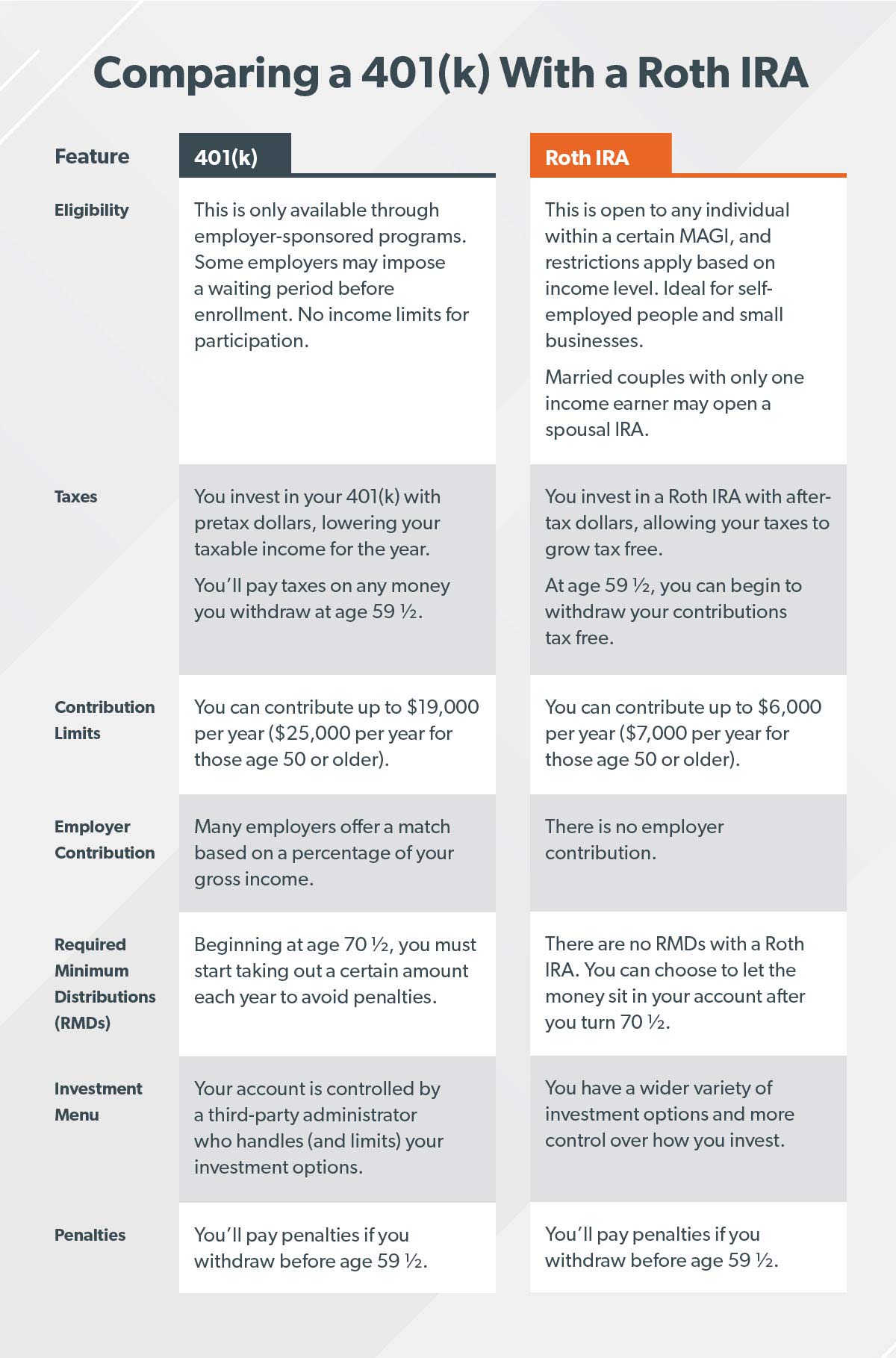

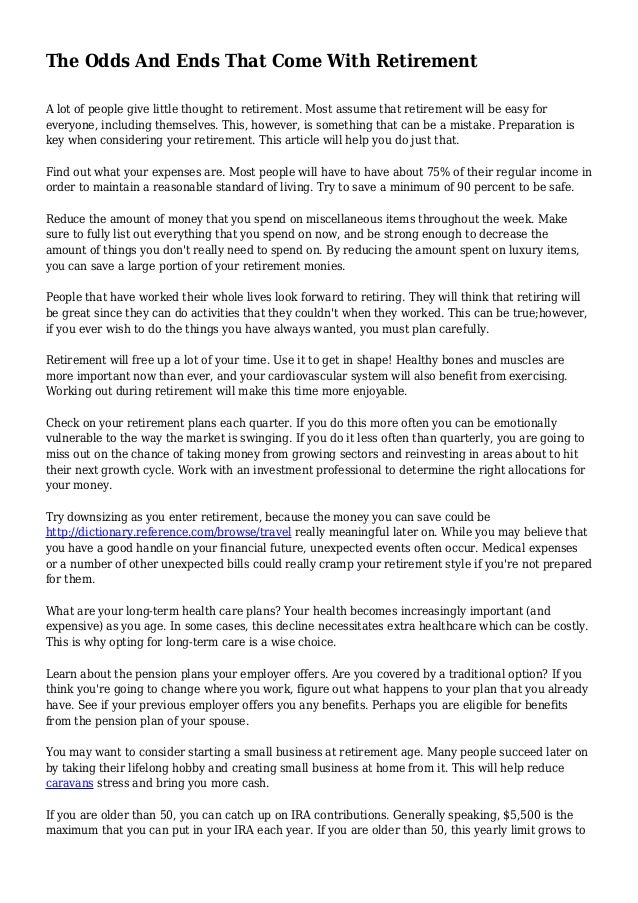

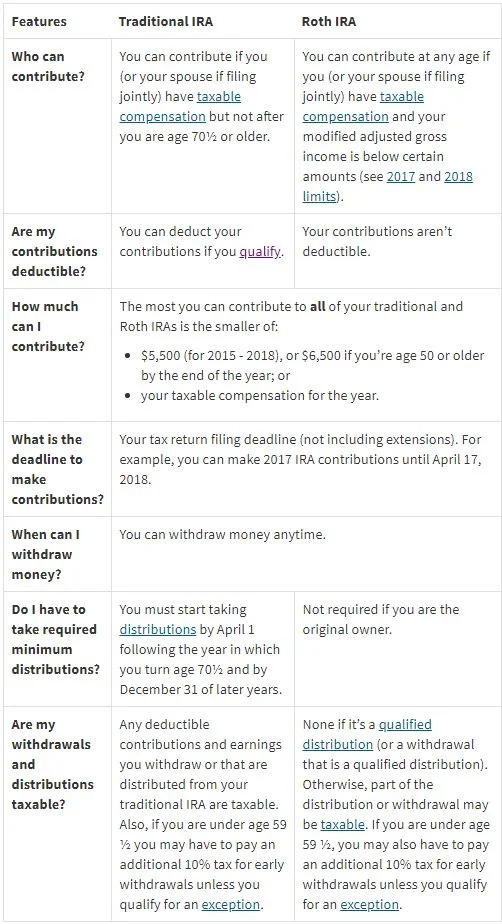

Most you can put in a ira. For 2018 5500 or 6500 if youre age 50 or older by the end of the year. You must have earnings from work to contribute to an ira. The annual contribution limits for iras vary from year to year with inflation.

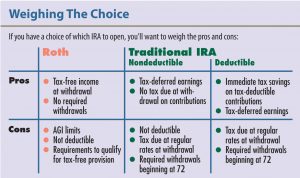

Iras have annual contribution limits that collectively apply to all deposits made to either a traditional ira a roth ira or both. As of 2018 youre allowed to contribute up to a maximum of 5500 to an ira. Unlike 401ks which are accounts provided by your company the most common types of iras are accounts that you open on your own.

If youre age 50 or older you can make an additional catch up contribution of 1000 per year for a total of 6500. The maximum contribution that you can make to a traditional or roth ira is the smaller of 6000 or the amount of your taxable compensation for 2019. The most you can contribute to all of your traditional and roth iras is the smaller of.

Workers age 50 and older can add an extra 1000 per year as a catch up contribution bringing the maximum ira contribution to 7000. This limit can be split between a traditional and a roth ira but the combined limit is 6000.

What Is A Roth Ira A Tax Advantaged Way To Save For Retirement Business Insider

www.businessinsider.com

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8.png)

/how-to-invest-in-real-estate-with-a-self-directed-ira-4057066-f5cd0b277c2d44db935f441fb523dcc5.gif)

/ira-5bfc372546e0fb00265ec944.jpg)