Most You Can Put In An Hsa

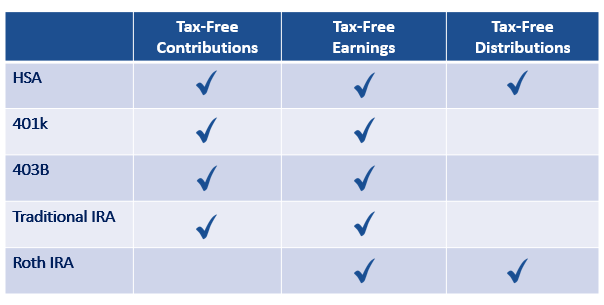

Health Savings Account Hsa Vs 401 K Flexible Benefit Service Corporationhealth Savings Account Hsa Vs 401 K

www.flexiblebenefit.com

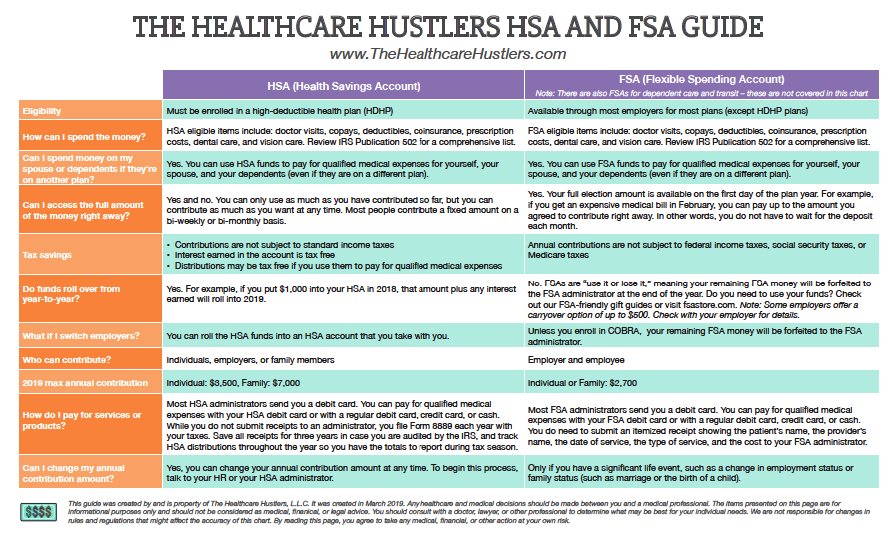

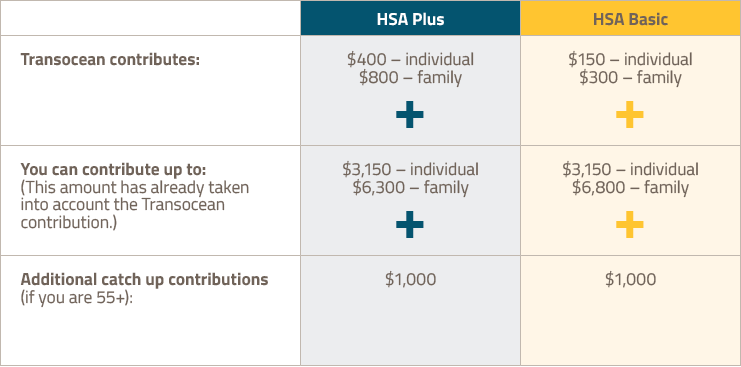

If you have an hsa and youre 55 or older you can make an extra catch up contribution of 1000 per year and a spouse who is 55 or older can do the same provided each of you has his or her own.

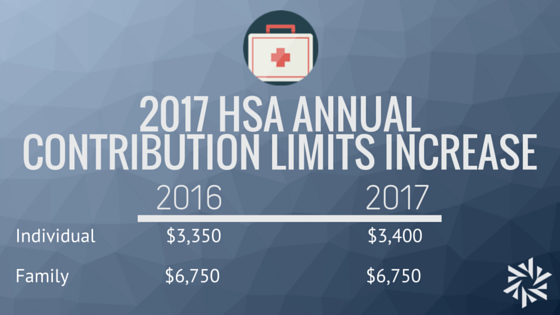

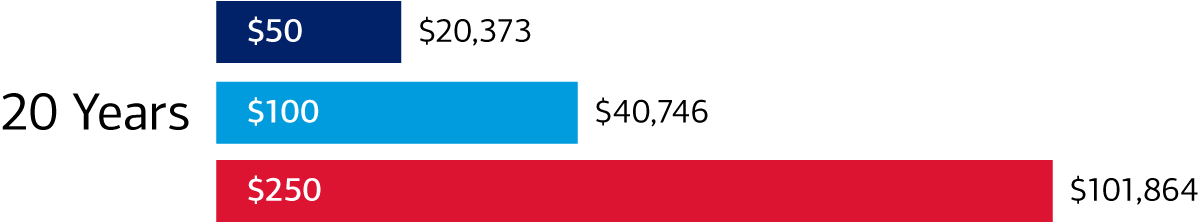

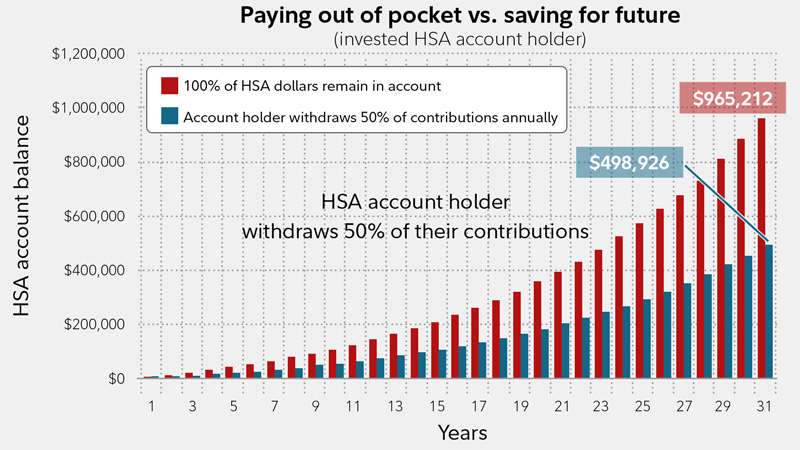

Most you can put in an hsa. As an individual you can put up to 3550 an hsa in 2020. You can put money into your hsa take it right out and the government just paid 25 of the bill. Learn how to maximize your usage of an hsa.

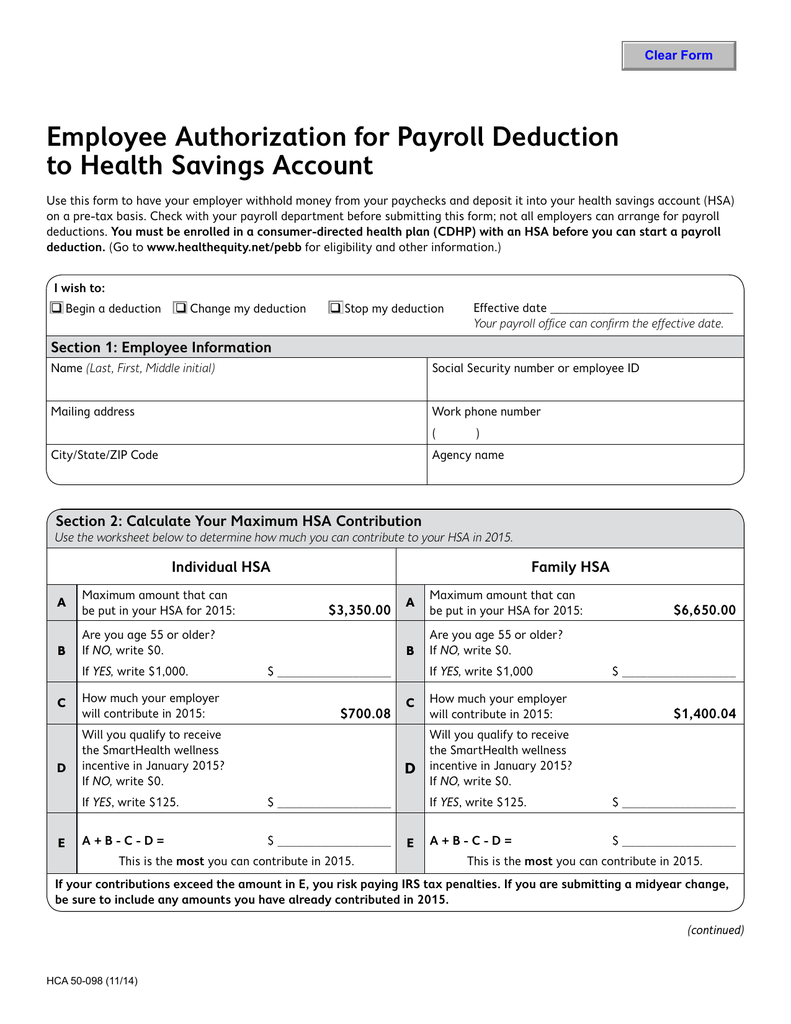

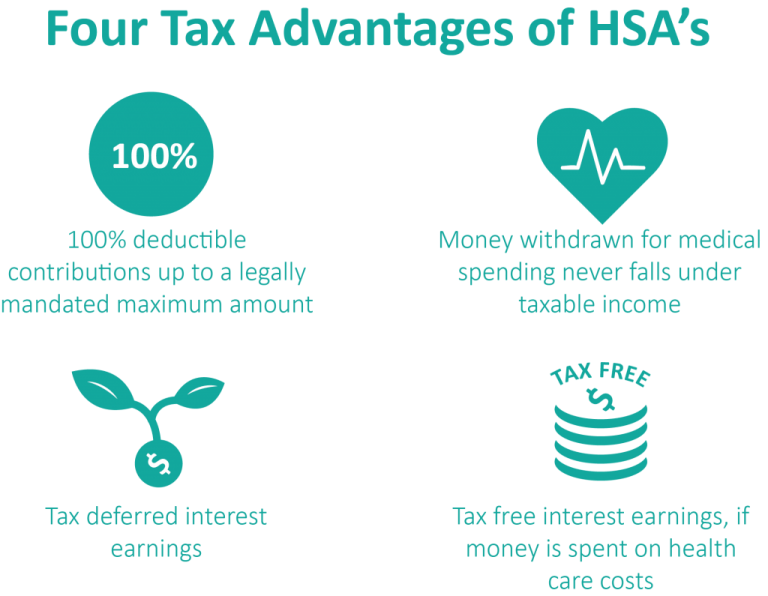

Lump sum contributions are permitted and you can make your annual contribution for the previous tax year anytime before your tax filing date. Hsa contribution limits in 2020 find the most recent rules about hsa contributions and health savings account limits for 2020. One of the most attractive features of an hsa are the tax free contributionsyou can add to your hsa straight from your paycheck by using a pretax payroll deduction.

For 2020 the maximum contribution amounts are 3550 for individuals and 7100 for family coverage. If you are 55 or older you can put an additional 1000 in an hsa. You do not have to make contributions monthly.

For example persons with hsas could make contributions for the 2009 tax year anytime before april 15 2010. Now just like with a 401k or an ira theres a limit to how much money you can put into an hsa each year. You can only open and contribute to a hsa if you have a qualifying high deductible health plan.

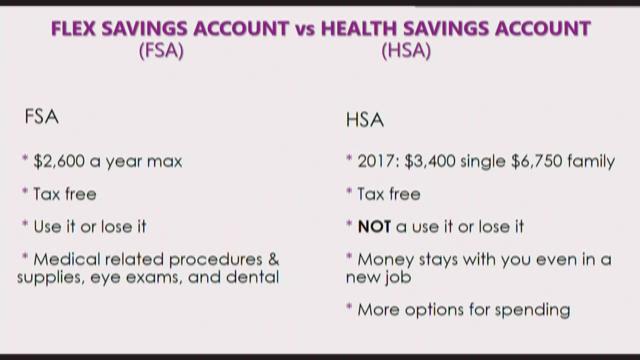

That means that you can use your tax preferred health savings account hsa funds to pay for expenses incurred for these purposes. Why wouldnt you just keep that 3550 or 7100 in a savings account. Finally its important to know that in most cases you cant have both an hsa and an fsa.

The higher your tax bracket the bigger your savings but the real juice to an hsa is to use it. If youre age 55 or older you can save an extra 1000 each year to play catch up. And in 2019 the irs provided guidance that hsa eligible hdhps should consider a number of popular medical services medications and devices such as insulin inhalers and statins as preventative care.

For 2019 the most you can contribute to an hsa is 3500 for individuals and 7000 for families. You cant take money from an employer sponsored fsa with you if you change jobs or retire.

/135309863-56a938963df78cf772a4e4a9.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/135309863-56a938963df78cf772a4e4a9.jpg)