Should You Cancel A Secured Credit Card

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqc7ix51fnggvffe Fh6klgzysryssqjeeldxsndotbwzwjdxyb Usqp Cau

encrypted-tbn0.gstatic.com

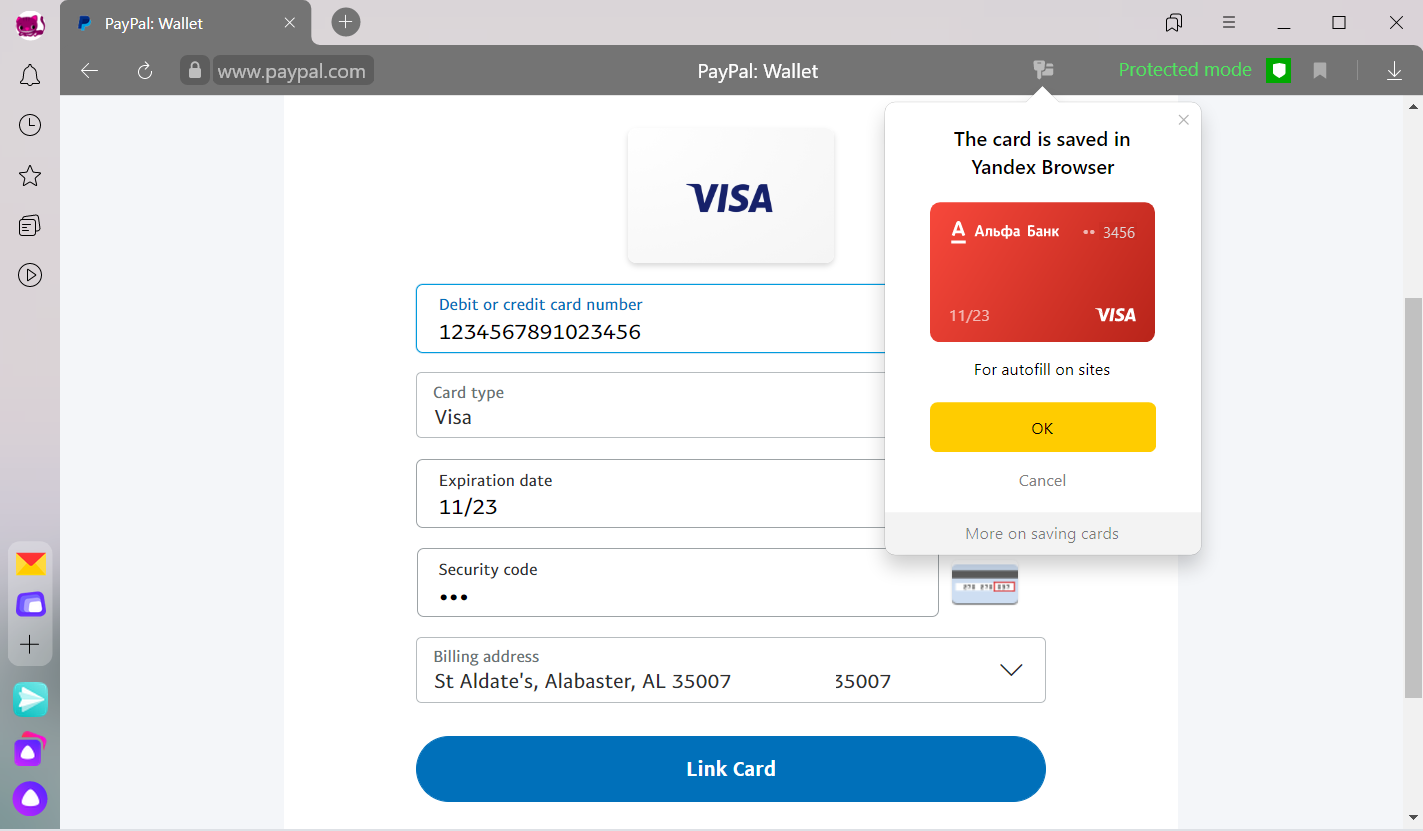

The last thing you want is to owe money on a credit card that you have to keep paying for after you close it.

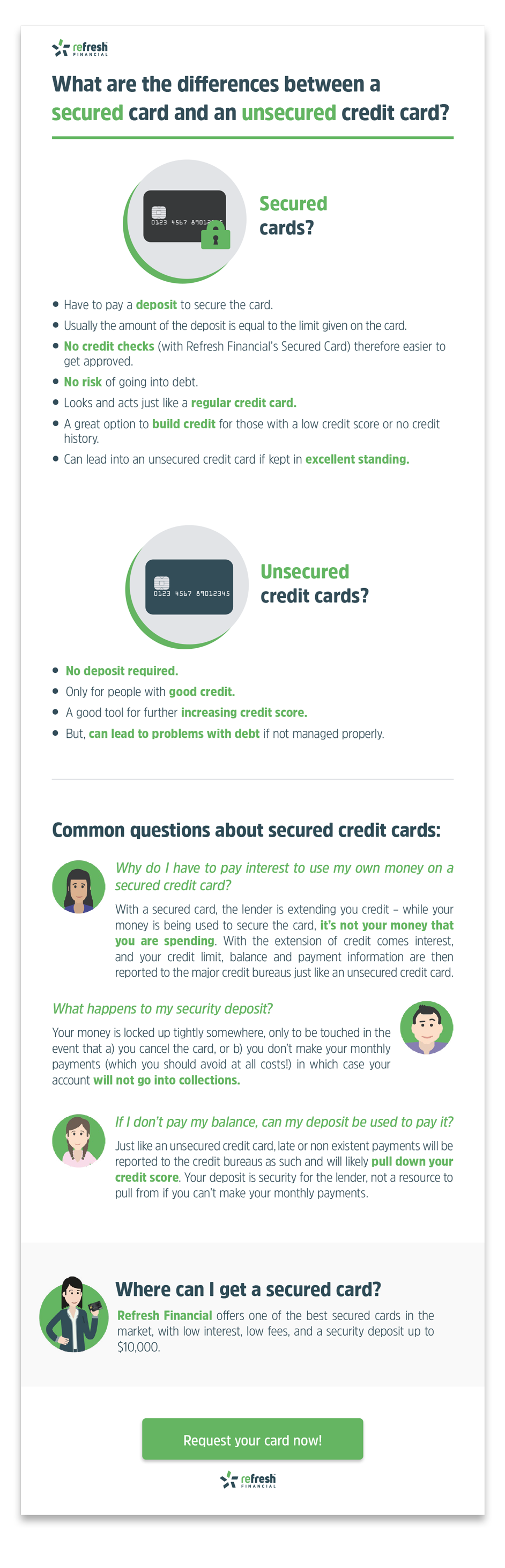

Should you cancel a secured credit card. However if you do not plan to use the card you may want to close the account because it is the right thing to do for you financially. If you have an outstanding amount on the card you should make full payment over the phone or make an online or. You should aim to pay your credit card balances off in full every month.

Getting your balance down to 0 is cause for celebration but its not necessarily cause. Why you shouldnt cancel a credit card. Call your credit card issuer to cancel and confirm that your balance on the account is 0.

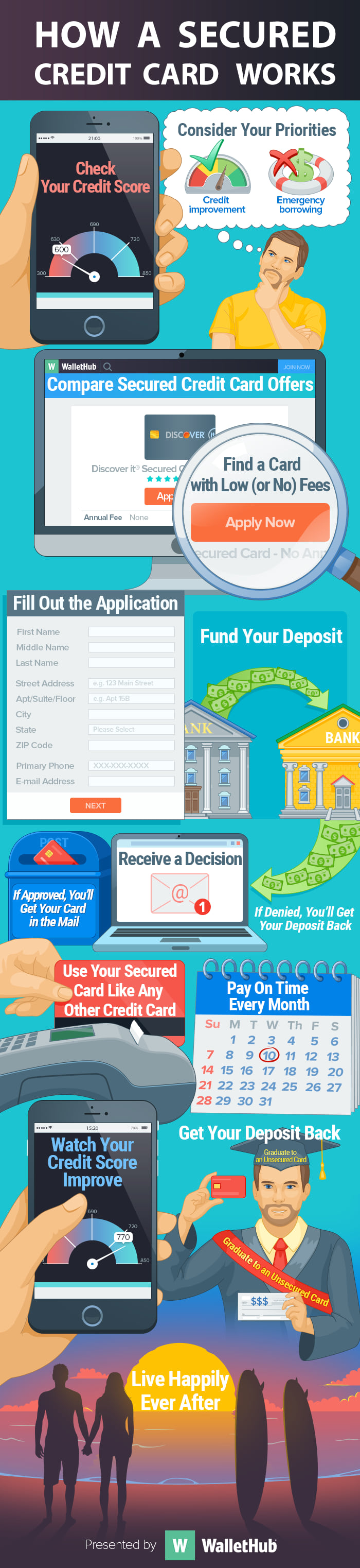

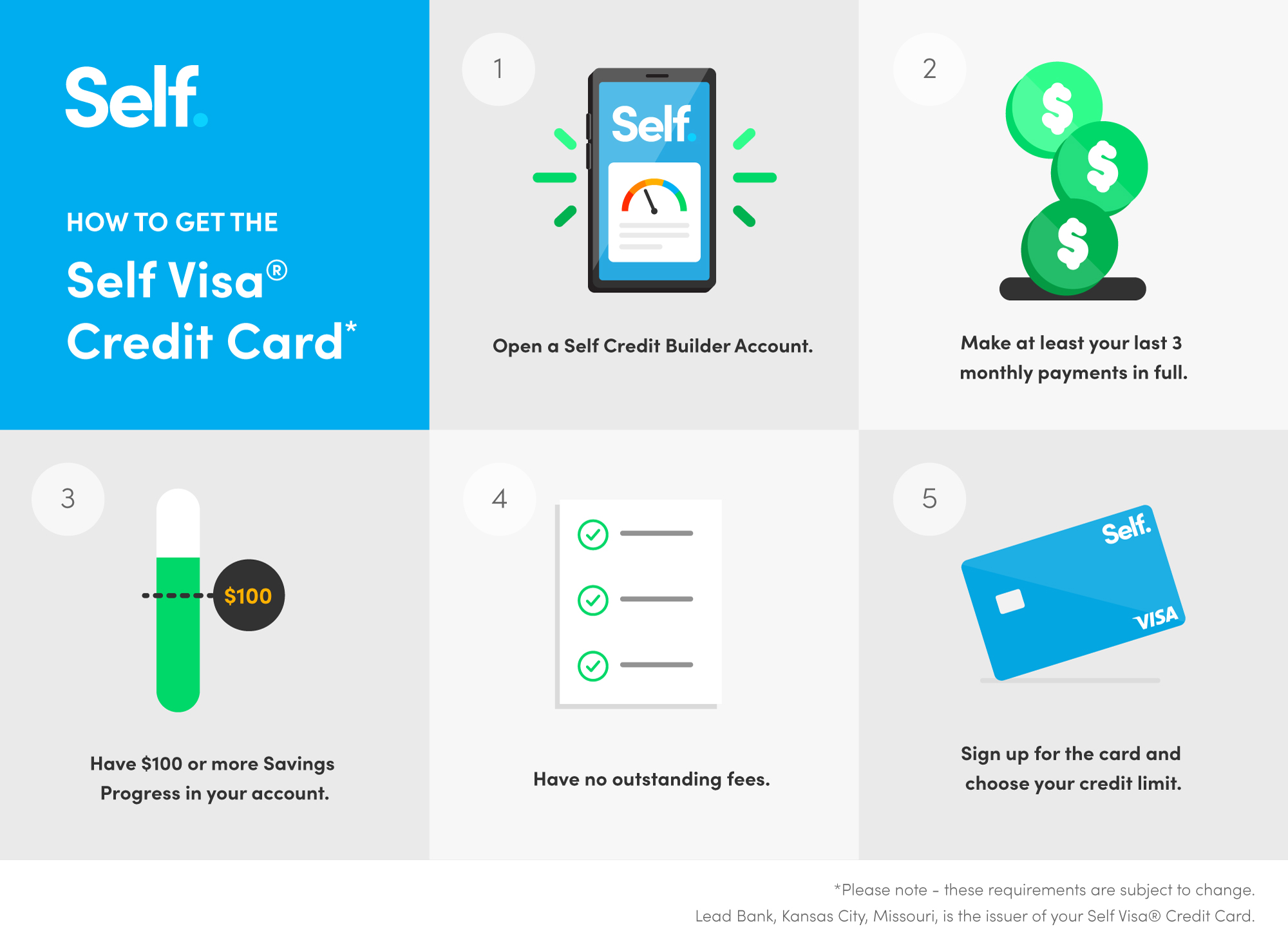

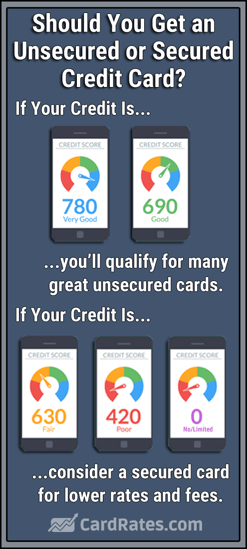

When youre ready to close your secured credit card heres the best way to do it if youre ready to move on from your secured credit card to a traditional card that can earn you rewards consider. A secured credit card can help you establish or re establish your credit. However pursue all credit products prudently.

If youve considered all your options and still want to go through with canceling a credit card heres how to do it. Tell the bank that you would like to close your secured credit card at the cardholders request and give the date you want the cancellation to be effective. A secured credit card is.

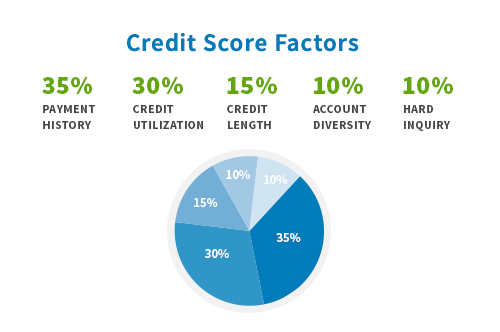

Since payments are included in your credit report paying on time and managing your balance will help improve your credit score. Then you can safely cancel the secured card. A third card in the mix can be beneficial especially if it has a valuable rewards program.

If you are planning to apply for credit in the near future especially for a major purchase such as a home or car you should use caution in closing accounts. Excess applications can drive a credit score down and you should only have the number of cards that you can impressively juggle. You paid off your balance.

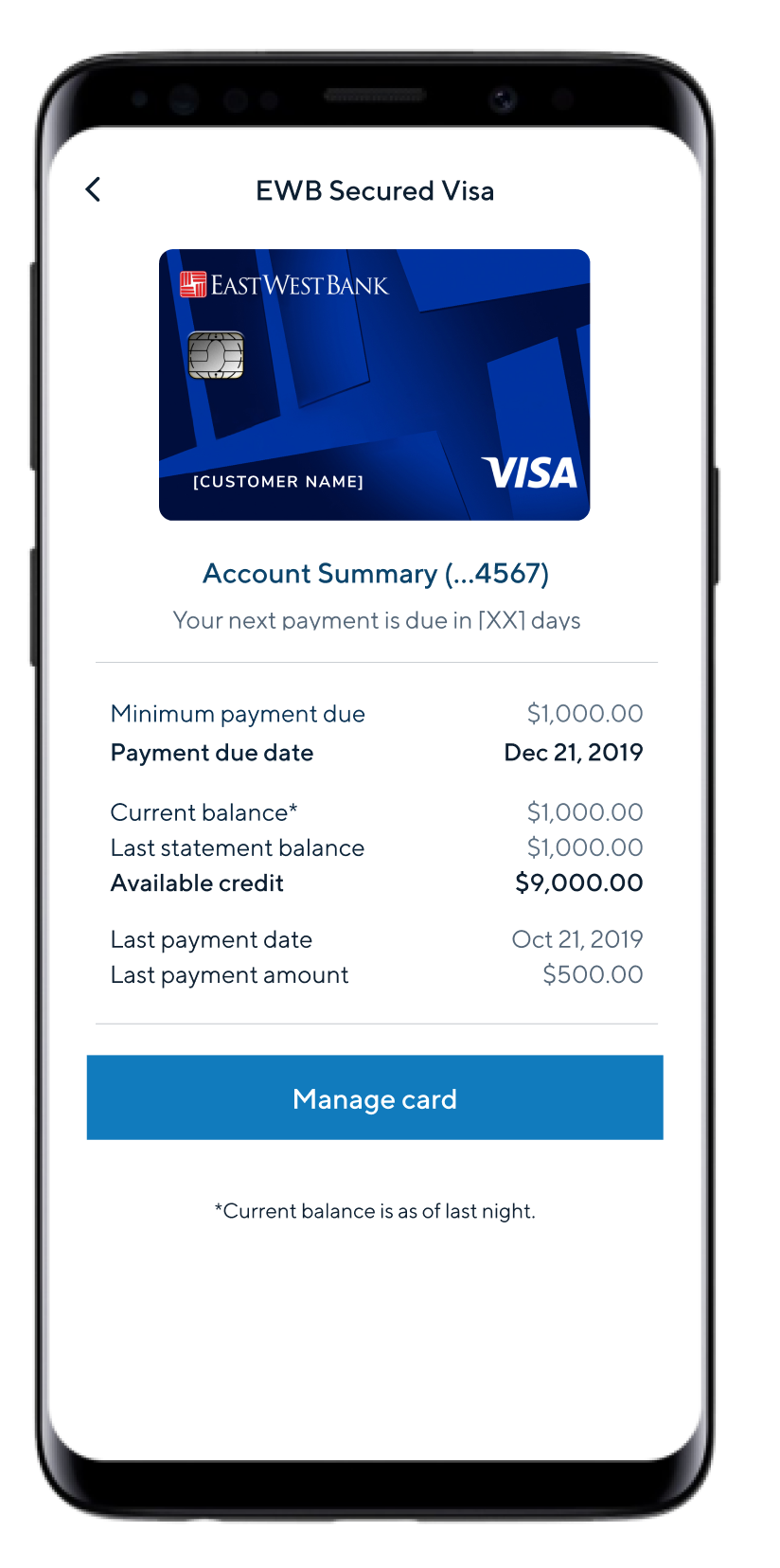

Pay off your remaining credit card balance. Look for the customer service number on the back of your credit card and call to cancel your account. After raising your credit score you may be able to qualify for a regular credit card.

Why you should close a credit card. If you carry a balance on any of your open accounts canceling your secured credit card will also raise your average credit utilization. During the conversation its a good idea to make note of who you spoke with and what their instructions were.

Think of canceling your card as a clean break.

/GettyImages-76185953-573d25565f9b58723d90b869.jpg)

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

/how-to-get-a-credit-card-with-no-credit-history-960228_final-a41f121e97334815b26f1d506ec3bd1a.png)

/cancel-credit-cards-56a6350e3df78cf7728bd67e.jpg)