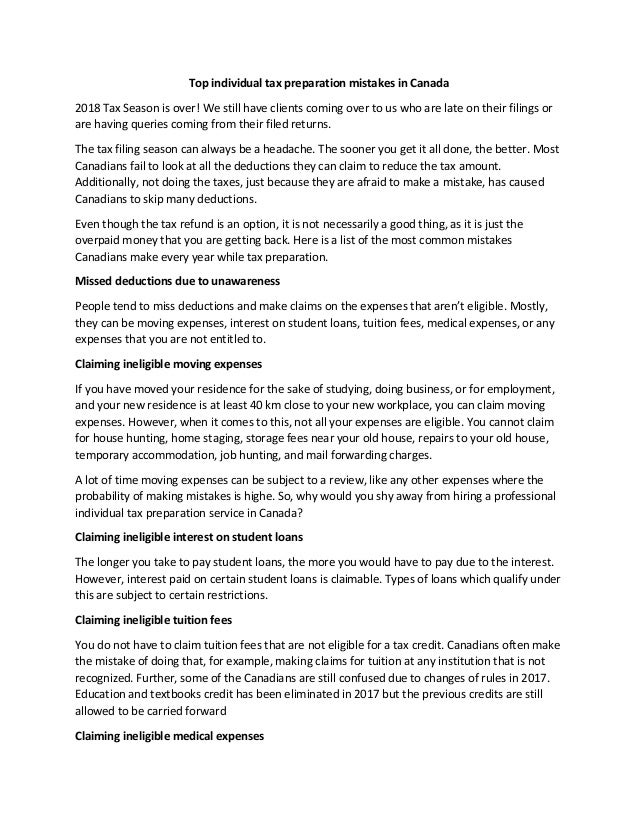

Who You Can Claim On Taxes

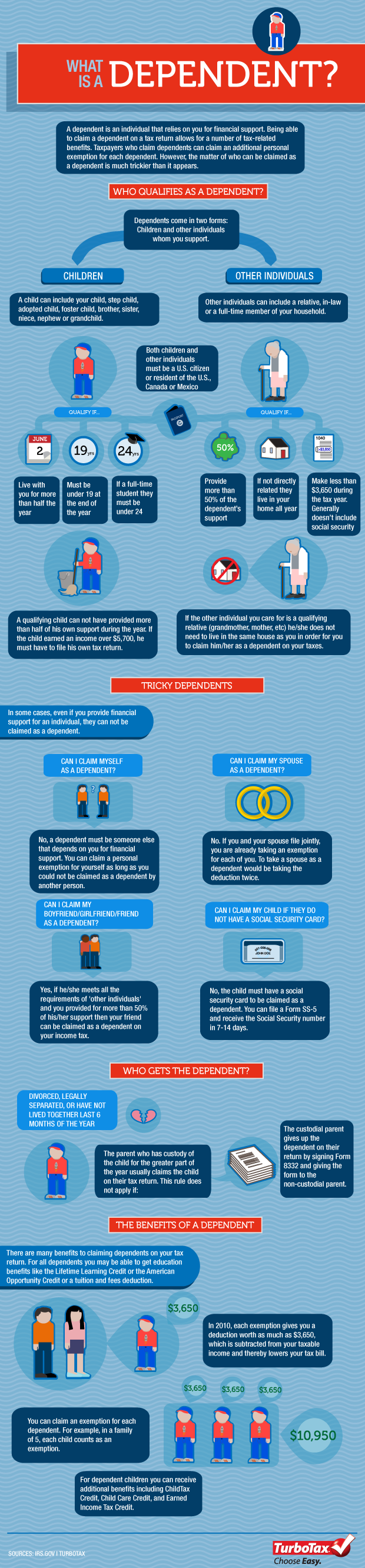

You cant claim someone who claims themselves on their taxes or claims another dependent on his own tax form.

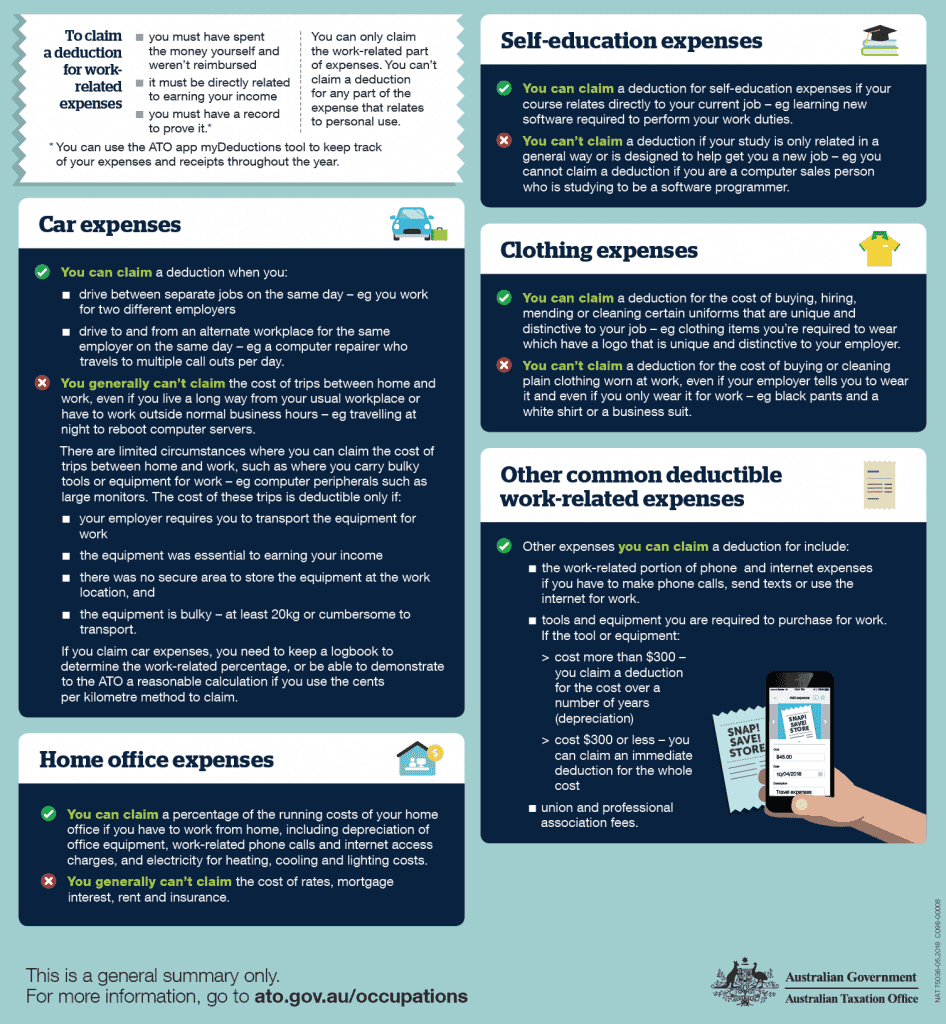

Who you can claim on taxes. You may be able to claim someone who lives with you as an exemption on your income taxes provided you support this person. Are you confident in your knowledge of all things claimable on your taxes. The change was part of tax reform legislation passed in 2017.

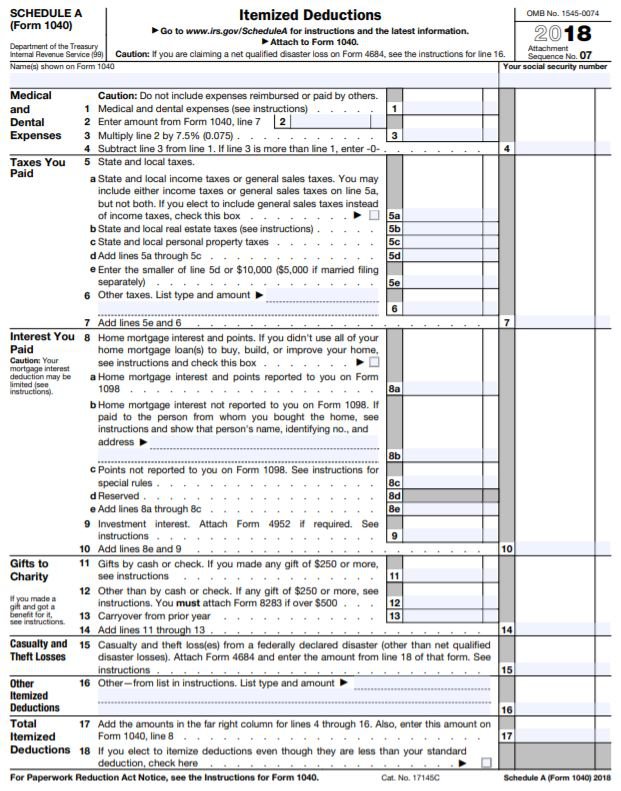

For the purpose of paying taxes and filing tax returns being able to claim a dependent means you can access certain deductions and credits which can ultimately lower your tax burden. You cannot claim someone who is married and files a joint tax return. You claim the credit when you file your federal income tax return.

This add up to substantial savings on your tax bill. This interview will help you determine whom you may claim as a dependent. Understanding what you can claim will help you get the largest tax refund to which you are entitled.

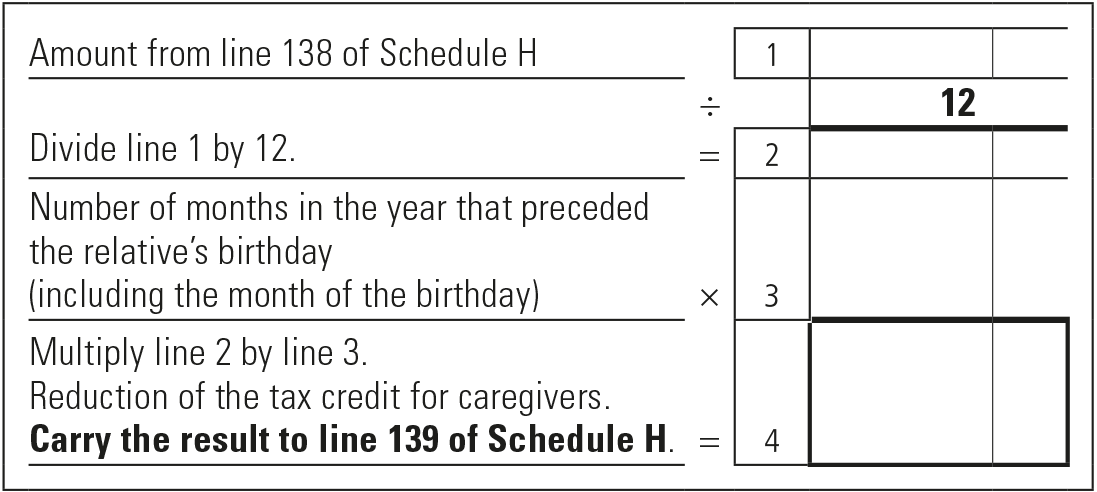

In the middle of the first page youll see a box labeled dependents. For tax years prior to 2018 every qualified dependent you claim you reduce your taxable income by the exemption amount equal to 4050 in 2017. The credit is refundable up to 1400.

If you paid someone to care for your child dependent or spouse last year you may qualify for the child and dependent care credit. Marital status relationship to the dependent and the amount of support provided. You can deduct 3650 from your taxable income for each exemption that you claim in 2010.

Increasing the child tax credit. A list of things you can claim on your taxes by morgan crouch updated march 28 2017. You can claim the child and dependent care credit for qualifying individuals a qualifying individual includes your child under age 13.

Basic income information such as your adjusted gross income. If you are eligible to claim the credit you could receive a credit of up to 2000 per qualifying child which is twice the amount you could claim under the old rules. For 2017 returns the personal exemption was worth 4050 for each person on your return which reduced your taxable income.

If you filed taxes in 2018 or later youll find your dependents listed on form 1040 us individual income tax return. Unfortunately must of us are not. If no person supplied more than half of the potential dependents support the terms of any multiple.

Until the passage of the tax cuts and jobs act in december 2017 you could claim an exemption for having dependents that would further reduce the part of your.

Income Tax Deduction Exemptions Section 80c 80ccd 80d 80gg Finserv Markets

www.bajajfinservmarkets.in

Form P87 Claim For Tax Relief For Expenses Of Employment Low Incomes Tax Reform Group

www.litrg.org.uk

/claiming-adult-dependent-tax-rules-4129176_color3-29b00ca3129544f9b2dbc50675d04c90.gif)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-485402301-576af9e35f9b5858755e0de6.jpg)

/what-if-someone-else-claimed-your-child-as-a-dependent-b94b766af2214ee3a02dd19b44116bcf.png)

:max_bytes(150000):strip_icc()/head-of-household-filing-status-3193039-finalv4-ct-fa1b9cd4bb4a4b87adde82fa4c814ff5.png)

/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg)